|

Notice: The information on this page is only for users of Personal Taxprep 2018. If you are using Personal Taxprep Classic 2018, consult the Professional Centre in your program or our Web site. To regularly receive information on the latest version of Personal Taxprep, make sure that you are subscribed to the enhanced edition of Taxprep e-Bulletin service. Consult the News and Product Support page of our Web site to check your Taxprep e-Bulletin service subscription. |

Release Notes

About

This version contains most of the forms released by the Canada Revenue Agency (CRA) and Revenu Québec (RQ) for the 2018 taxation year. These forms were approved by the tax authorities and allow you to file income tax returns for taxpayers who do not require the forms listed in the “Calculations and Forms Not Available or Under Review” section.

This version of Personal Taxprep was updated in order to integrate the most recent tax measures pursuant to the 2018 taxation year.

Training

To allow you to familiarize yourself with the new enhanced Personal Taxprep interface, a free live Webinar is available to you. To learn about the presentation dates and register for the session most convenient for you, go to Webinars > Session Calendar.

To consult the other training options available regarding Personal Taxprep (seminars, Webinars, tutorials and more), access the "Training" section of the Taxprep Web site. You can also access it from the program, by selecting Get Taxprep Training in the Help menu.

Rolling Forward Preparer Profiles

Once your preparer profiles from last year are rolled forward to the current year, it is important to verify that the options defined with respect to the returns of your clients and to the electronic filing of data (EFILE) still correspond to your situation for the current season. For more information on the new options offered in the preparer profiles of the current version, please refer to the “Modifications Made to Forms” section.

TaxprepConnect for the 2018 tax season

Important dates

Federal

Federal

February 18, 2019 – The Auto-fill T1 return service will open. The CRA tax data can be downloaded using TaxprepConnect commencing with version 2.0 of Personal Taxprep 2018.

Québec

Québec

March 4, 2019 – The Tax Data Download service will open. The Revenu Québec tax data can be downloaded using TaxprepConnect commencing with version 3.0 of Personal Taxprep 2018.

Auto-fill T1 return – Downloading prior-year data

It will now be possible to download tax data from the previous three years (2015, 2016 and 2017). To download data of a given year, you will have to use the Personal Taxprep program of the year in question.

Note that only data on slips of prior years will be available; data that does not relate to a specific year, such as carried forward balances, will not be available.

Tax Data Download of Revenu Québec

For the 2018 taxation year, you will be able to download a taxpayer’s data without having to use a download code. To do so, a valid MR-69 form will have to be sent beforehand to Revenu Québec.

Note that you can still get a download code with Revenu Québec, as in the past, and use it to download a taxpayer’s tax data.

What’s New?

Québec

Québec

MR-69 – Authorization to Communicate Information or Power of Attorney (Jump Code: Q69) – Printing the two-dimensional (2D) bar code

In accordance with Revenu Québec requirements, a 2D data bar code now prints on Form MR-69.

Note that the identification bar code and data bar code are only visible when printing, i.e. on paper or in PDF format.

Here is an overview of the other modifications performed:

Fields 22a, 22b, 22c and 22d in Section 3.2.1 have been modified and now require the entry of eight digits instead of seven. When opening a client file prepared with a prior version of Personal Taxprep in which a file number was entered on one of lines 22a to 22d, the number will be retained, but the 0 prefix will be added to it.

Fields 31a, 31b and 31c in Section 3.2.2 have been modified and now contain six characters, i.e. two letters followed by four digits. When opening a client file prepared with a prior version of Personal Taxprep in which a file number was entered on one of lines 31a to 31c, the number will be retained, but the ER prefix will be added to it.

In addition, lines 37, Source deductions of support payments, and 38, Mining tax return(s) have been added to the form.

Line 36 has been renumbered and now corresponds to line 45.

The “Revocation” section has been removed. To revoke an authorization or a power of attorney, complete the MR-69.R form on the Revenu Québec Web site.

Modifications related to EFILE

Québec

Québec

Transmission of amended TP1 returns

Personal Taxprep 2018 v.2.0 will allow for the electronic transmission of amended TP1 returns.

The procedure to transmit an amended TP1 return to Revenu Québec similar to the one used to transmit an amended T1 return to the CRA, which has been available for a few years.

To take this new possibility into account, changes have been made to Forms T1-ADJ and TP-1.R. The question Do you want to electronically retransmit the amended TP1 return instead of mailing a TP-1.R form? has been added.

As for the federal returns, when you use this service to transmit a return to Revenu Québec, the program will transmit an entire TP1 return reflecting the desired changes and not Form TP-1.R, Request for an Adjustment to an Income Tax Return (Jump Code: QTP1R).

However, a TP-1.R form will be automatically be generated in Personal Taxprep during the retransmission process so that you can review the lines amended in the return and make sure that only the desired changes were made.

Therefore, as for the federal returns, the procedure to prepare an amended TP1 return is similar to the existing process for the automatic preparation of an adjustment request. We recommend that you create a copy of the tax return before making the adjustments.

To electronically transmit an amended TP1 return, answer “Yes” to the question Do you want to electronically retransmit the amended TP1 return instead of mailing a TP-1.R form? This question can be answered in one of the two following locations: at the top of the T1-ADJ form or at the top of the TP-1.R form.

When you answer “Yes” to this question, the EFILE TP1 status stops being “Accepted,” and you can then make the desired changes. Follow the steps presented in the TP-1.R form to electronically transmit the amended TP1 return.

The lines that have been modified in the return display in the TP-1.R form, just as the change intended for the refund or balance due. You can print the TP-1.R form for reference purposes or give it to your client. However, your client is not required to sign the form.

Unlike the CRA, that requires that a new copy of Form T183 be signed before an amended T1 return is transmitted, Revenu Québec does not require a signature on a new copy of the TP-1000 form, but rather, that the preparer has a valid authorization or power of attorney (Form MR-69) for the taxpayer. Without a valid MR-69 form, you will be unable to electronically transmit an amended TP1 return for this taxpayer.

If you have a valid MR-69 form, you can transmit a TP1 return in the same manner as the original.

Once the transmission is accepted by Revenu Québec, the confirmation number and the date of acceptance will be saved and Forms TP-1.R and EFILE INFO, EFILE Information (Jump Code: EFILE INFO).

The EFILE exclusions that apply to the transmission of the original TP1 returns also apply to the transmission of amended returns.

Improve Your Productivity

ID – Identification and Other Client Information (Jump Code: ID)

Lines to enter the cellular number and the e-mail address for the spouse have been added to the “Spouse – Identification” section.

SCENARIOS (Jump Code: SCENARIOS)

Delete buttons have been added in the four tax scenarios worksheets (SCENARIOS, QSCENARIOS, CPLSCEN and QCPLSCEN). These buttons allow you to reset data of a scenario transferred in a column. The prior version did not allow for emptying a column in which data had been copied, but only to copy a new scenario again.

Forms, Schedules, and Workcharts Added to the Program

Federal

Federal

Schedule 14 – Climate Action Incentive (Jump Code: 14)

This form is used to calculate the new “Climate Action Incentive” tax credit. This credit applies to eligible individuals whose province of residence on December 31 is Ontario, Saskatchewan, Manitoba or New Brunswick.

The climate action incentive (CAI) is a refundable credit which consists of a basic amount and a supplement for residents of small and rural communities. Consult the form for information on all conditions.

In its calculations, the program takes into account most of the criteria required to allocate this new tax credit. A checklist and diagnostics have been included to help you complete the required information.

This credit can be claimed on the line 449, which has been added to a new Income Tax and Benefit Return for the provinces of Ontario, Saskatchewan, Manitoba and New Brunswick.

Québec

Québec

TP-517.5.5 – Designating a Deemed Capital Gain Further to the Transfer of a Family Business (Jump Code: Q51755)

This form is used to calculate the amount that can be designated as capital gain further to the transfer of a family business. The deemed capital gain in this situation is, however, limited to the capital gains deduction amount available. That limit is calculated in this form.

To claim the capital gains deduction of the deemed capital gain resulting from the disposition of qualified shares, first complete Form TP-517.5.5 and the deemed capital gain that can be designated will be updated to Schedule G, Capital Gains and Losses (Jump Code: QG). Form TP-726.7 will then be completed automatically to calculate the capital gains deduction on qualified property.

The excess that cannot be considered as a deemed capital gain is to be reported as a deemed dividend. For purposes of the federal return, the total gain must be reported as a deemed dividend. Diagnostics have been included to guide you.

To learn about all the conditions in order for the transfer of the family business to be considered as an eligible business transfer and for more information, consult guide IN-120, Capital Gains and Losses.

TP-752.HA – Home Buyers’ Tax Credit (Jump Code: Q752.HA)

A taxpayer could be entitled to the home buyers’ tax credit if he or she is a resident of Québec on December 31, 2018, and he or she meets one of the following two criteria:

- the taxpayer or the spouse bought a qualifying home for the first time and intends to make it their principal place of residence (note that taxpayers are considered to have bought a home for the first time if they did not live, in the current year or in the four preceding years, in another home they or their spouse owned);

- the taxpayer bought a qualifying home and intends to make it the principal residence of someone related to him or her who has a disability.

The maximum tax credit amount that can be claimed with respect to a qualifying home in $750. The credit can be split between the taxpayer and spouse as well as any other co-owner.

TP-1029.SA – Senior Assistance Tax Credit (Jump Code: Q1029.SA)

This form is used to calculate the new refundable senior assistance tax credit, which has been announced in the fall 2018 Update on Québec’s Economic and Financial Situation.

This tax credit is for individuals who resided in Québec and were at least 70 years of age on December 31, 2018, or on the date of their death in 2018. The credit can be split between both spouses when the family situation on December 31 is “with spouse” and both spouses are eligible for the credit.

The maximum tax credit is:

- $400 for an eligible individual with a spouse on December 31 and whose spouse is also eligible for the tax credit;

- $200 for an eligible individual with a spouse on December 31 if only the individual is eligible for the tax credit;

- $200 for an individual without a spouse on December 31.

The tax credit will be reducible by 5% of the family income that exceeds:

- $36,600 for an individual with a spouse on December 31;

- $22,500 $ for an individual without a spouse on December 31.

The family income used to calculate this credit corresponds to the amount on line 275 of the tax return. If the taxpayer has a spouse on December 31, the family income corresponds to the total of the amount on line 275 of the taxpayer’s tax return and the amount on line 275 of the spouse’s tax return.

TPF-1.C – Explanations Regarding an Amended Income Tax Return (Jump Code: TPF1C)

This form has been added to allow you to enter explanations when you print an amended TP1 return and mail it to Revenu Québec. For more information, consult the Help.

Modifications Made to Forms

Federal

Federal

T4 – Statement of Remuneration Paid (Jump Code: T4)

The following boxes have been removed from the T4 slip:

- Box 37, Employee home-relocation loan deduction

- Box 84, Public transit pass

T4A – Statement of Pension, Retirement, Annuity & Other Income (Jump Code: T4A)

Box 128, Veterans' benefits eligible for pension splitting (included in box 016), has been added to the T4A slip. As indicated in the instructions on the slip, this amount will also be included in box 016. In the program, to prevent duplicate taxation of this amount in the tax return, you must enter it only in box 128 and it will be automatically updated to box 16.

T4A – Box 117 – Loan benefits

Box 117 of the T4A slip includes the amount of benefits related to a loan granted to a shareholder. As this amount constitutes investment income under subsection 15(1) ITA, it should be taken into account in Part 2 of Form T936, Calculation of Cumulative Net Investment Loss (CNIL) (Jump Code: 936). A modification has been made to the calculation of Form T936 to take this into account.

T4A(P) – Statement of CPP or QPP Benefits (Jump Code: T4AP)

Starting in 2018, the beneficiary of the estate of a deceased person who received a CPP or QPP death benefit (box 18 of the T4A(P) slip), should enter this amount on line 130 of the 2018 T1 return. Previously, the amount in box 18 of the T4A(P) slip was updated to line 115 of the T1 return.

Schedule 1 Line 398 – Home Accessibility Expenses (Jump Code: 398)

Schedule 12, Home Accessibility Expenses, has been removed from the program. The tax credit for home accessibility still exists but is now calculated in Form Schedule 1 Line 398 – Home Accessibility Expenses.

Principal residence – Roll forward and diagnostic

In Personal Taxprep 2017, the line The taxpayer disposed of a principal residence after the end of the taxation year had been added to the “Mailing address” section in the Identification form so that you can indicate whether the taxpayer disposed of a principal residence in 2018.

In Personal Taxprep 2018, for the rolled forward files in which the answer to the above-mentioned question was “Yes,” the answer on the line The taxpayer disposed of a principal residence in the current taxation year for which he or she claims the total or partial exemption. will default to “Yes,” and a diagnostic will prompt to complete the “Principal residence” section in Schedule 3 as well as Form T2091 or Form T1255, if the taxpayer is deceased.

Investments – Statement of Investment Income, Carrying Charges, and Interest Expenses (Jump Code: INVESTMENTS)

Schedule 4, Statement of Investment Income, has been removed from the program and has been replaced by a calculation worksheet. This worksheet contains data from lines 120, 121, 180 and 221 of the income tax and benefit return.

T657 – Calculation of Capital Gains Deduction (Jump Code: 657)

Capital gains arising from the disposition of property made after 2007 and before 2014 give rise to a $375,000 cumulative deduction, which represents half of a lifetime exemption of $750,000.

Capital gains arising from the disposition of property in 2014 give rise to a $400,000 cumulative deduction, which represents half of the $800,000 lifetime exemption. The amount of this cumulative deduction has been indexed from 2015 to 2018 and will continue being indexed each year, until it reaches $500 000, which represents half of a lifetime exemption of $1,000,000.

As a result, for the gains arising from the dispositions of property in 2015, the cumulative deduction is $406,800, which represents half of a lifetime exemption of $813,600.

For gains arising from the disposition of property in 2016, the cumulative deduction is $412,088, which represents half of a lifetime exemption of $824,176.

For gains arising from the disposition of property in 2017, the cumulative deduction is $417,858, which represents half of a lifetime exemption of $835,716.

For gains arising from the disposition of property in 2018, the cumulative deduction is $424,126, which represents half of a lifetime exemption of $848,252. Note that the new limit of tax-exempt gains is not included in the version, because of the late receipt of the CRA form.

In addition, for dispositions of qualified farm property or qualified fishing property made after April 20, 2015, the cumulative deduction is $500,000, which represents half of the $1,000,000 lifetime exemption. The dispositions of small business corporation shares do not give rise to this additional deduction.

Donations – Charitable Donations (Jump Code: DONATIONS)

The First-Time Donor’s Super Credit applied to cash donations made after March 20, 2013, up to $1,000, reported for a single taxation year between 2013 and 2017. Because the super credit expired at the end of 2017, the calculations have been removed to no longer calculate this tax credit.

Client Letter Worksheet (Jump Code: LW)

Because the CRA stopped distributing copies of the preprinted T7DR(A) remittance voucher last year, the “EFILE remittance” section has been removed from the form. The “T7DR(A)” letter template has also been removed from the program.

T7DR(A) – Tax Return Remittance Voucher (Jump Code: T7DRA)

In the case of deceased persons’ returns, the address shown on the T7DR(A) remittance voucher is now that of the legal representative, as indicated on the T1 return.

Québec

Québec

RL-1 – Employment and Other Income (Jump Code: T4)

Box L-5, Employee home-relocation loan deduction, has been removed.

The deduction for police officers amount that was updated to box A-8 of the RL-1 slip is now grouped with the Canadian Forces personnel amount in box A-7. Therefore, this box includes the Canadian Forces personnel and police deduction amount.

RL-2 – Statement of Pension, Retirement, Annuity & Other Income (Jump Code: T4A)

The additional information box A-1, Deduction for an Indian, has been added to the T4A slip data entry screen. The amount entered in box 146 of the federal T4A slip will be updated to box A-1. As indicated in the instructions of the slip, this amount will also be included in box A. In the program, to prevent duplicate taxation of this amount in the tax return, you must enter it only in box 146 of the federal slip and it will be automatically updated to boxes A-1 and A.

RL-3, 15, 16 and 25 slips (Jump Codes: T5, T5013, T3 and T4PS)

Boxes have been added to each of these slips to allow you to indicate the amounts of ordinary and eligible dividends received before March 28, 2018, to correctly calculate the amount of the dividend tax credit on line 415 of the Québec TP1 return.

RL-26 slip – Capital régional et coopératif Desjardins (Jump Code: QR26)

The capital stock of Capital régional et coopératif Desjardins has been changed so that investors who have held shares of the capital stock for at least seven years can exchange them for shares of a new class of capital stock. This exchange will allow investors to benefit from a non-refundable tax credit corresponding to 10% of the value of the shares, up to a maximum of $15 000, namely a maximum non refundable tax credit of $1 500 annually.

RRSP – RRSP/PRPP/SPP Deduction Worksheet (Jump Code: RRSP)

To better guide you during data entry of contributions to VRSP contributions, the “PRPP” type has been renamed “PRPP/VRSP” in the Type drop-down list in the “Contributions” section of the RRSP/PRPP/SPP Deduction Worksheet form.

The voluntary retirement savings plan (VRSP) is a Group Retirement Savings Plan that can be offered by employers to their Québec employees.

QC Investments – Investment Income and Related Expenses (Jump Code: QINVESTMENTS)

The QA4, Investment Income and Related Expenses worksheet, has been replaced by the QINVESTMENTS calculation worksheet. Data on lines 128, 130 and 231 of this worksheet will update to the TP1 return.

In addition, following the March 27, 2018 Québec Budget, the tax credit rates for ordinary and eligible dividends have been modified.

Lines have been added to the calculation worksheet to allow you to indicate the amounts received before March 28, 2018, to correctly calculate the amount of the dividend tax credit on line 415 of the TP1 return.

TP1 Line 391 – Tax Credit for Experienced Workers (Jump Code: Q391)

The tax credit for workers 63 or older has been renamed “Tax credit for experienced workers.” The age of eligibility to the credit decreased from 63 to 61. The maximum tax credit is calculated based on the age of the taxpayer. It is:

- $450, if the taxpayer was 61 on December 31, 2018;

- $750, if the taxpayer was 62 on December 31, 2018;

- $1,050, if the taxpayer was 63 on December 31, 2018;

- $1,350, if the taxpayer was 64 on December 31, 2018; and

- $1,650, if the taxpayer was 65 or older on December 31, 2018.

The maximum amount of the eligible work income is also calculated based on the taxpayer’s age. It is:

- $3,000, if the taxpayer was 61 on December 31, 2018;

- $5,000, if the taxpayer was 62 on December 31, 2018;

- $7,000, if the taxpayer was 63 on December 31, 2018;

- $9,000, if the taxpayer was 64 on December 31, 2018; and

- $11,000, if the taxpayer was 65 or older on December 31, 2018.

In addition, the tax credit is reduced by 5% from the eligible employment income that exceeds $34,030, where applicable. However, this reduction is not applicable if the taxpayer was born before January 1, 1951, and the tax credit does not exceed $600.

T2042, T2121 and T2125 – CCA deduction worksheet (Jump Codes: 2042 CCA CLASS, 2121 CCA CLASS, 2125 CCA Class) – Additional Deduction for the Québec Capital Cost Allowance – CCA classes 50 and 53

In Forms T2042 CCA CLASS, T2121 CCA CLASS and T2125 CCA CLASS, the “Additional capital cost allowance (CCA) for Québec” section has been modified for purposes of calculating the additional CCA amounts for eligible property in CCA classes 50 and 53.

This section includes two subsections:

- “Additional CCA of 35%,” for qualified property acquired or available for use after March 28, 2017, and March 28, 2018, qualifying for the additional CCA of 35%.

- “Additional CCA of 60%,” for qualified property acquired or available for use after March 27, 2018, and before April 1, 2020, qualifying for the additional CCA of 60%.

The answer to the question Does this class include property eligible for the additional capital cost allowance for Québec? and the amounts entered on the lines UCC of qualified property that was acquired or became available for use in the preceding taxation year are determined when qualified property is listed in a copy of Form T2042 CCA FA, T2121 CCA FA or T2125 CCA FA of an eligible CCA class.

When the answer to the question is “Yes,” the amounts entered in fields “Additional CCA amount of 35%” and “Additional CCA amount of 60%” are calculated and the results are included on line 246 of Form TP-80 and line 9936 of Forms Q2042 and Q2121 respectively.

When rolling forward a client file, if an amount is entered on the line UCC of qualified property that was acquired or became available for use in the current taxation year in one of the above-mentioned two subsections, the answer to the question will be “Yes” and the amount on the line UCC of qualified property that was acquired or became available for use in the preceding taxation year in the corresponding subsection will be calculated based on data entered in that section.

TP1 Line 443 – Special Taxes (Jump Code: Q443) Income tax relating to the additional CCA of 35% or 60%

If qualified property in CCA classes 50 and 53:

- was acquired or became available for use after March 28, 2017, and before March 28, 2018, an additional CCA corresponding to 35% of the CCA amount claimed in Québec might have been claimed by the taxpayer;

- was acquired or became available for use after March 27, 2018, and before April 1, 2020, an additional CCA corresponding to 60% of the CCA amount claimed in Québec might have been claimed by the taxpayer.

If the taxpayer qualified for the additional CCA of 35% or 60% for qualified property and the taxpayer is not using this property mainly to carry out a business for at least 730 consecutive days after the property started being used, the taxpayer is subject to a special tax.

This special tax must be indicated on line 443 of the TP1 tax return. Two lines have been added to the form to enter the amount of special tax. A diagnostic has also been added to determine situations where the taxpayer can be subject to this special tax when disposing of qualified property in CCA class 50 or 53.

Schedule H – Tax Credit for Caregivers (Jump Code: QH) – section E

Form TP-1029.8.61.64 – Tax Credit for Caregivers (Jump Code: 102986164) – section D

Starting in 2018, a fourth type of caregiver can claim the tax credit for caregivers: i.e. caregivers who support an eligible relative and who provide continuous care and assistance to this relative who needs assistance to perform a basic activity of daily living.

To give rise to this tax credit, the eligible relative must comply with all of the following conditions:

- he or she must be 18 or over;

- his or her principal place of residence is situated in Québec;

- he or she does not live in a dwelling situated in a private seniors' residence or in a public network facility;

- he or she has a severe and prolonged impairment;

- he or she needs assistance in carrying out a basic activity of daily living.

The need for assistance in carrying out a basic activity of daily living must be certified by a physician or a specialized nurse practitioner who must complete lines 46 and 47 in Part 3 of Form TP 752.0.14 (Jump Code: Q752014). If the person requires assistance and Form TP 752.0.14 has already been filed in a year before 2018 or without lines 46 and 47 in Part 3 having been completed, the form must be filed again.

To claim the tax credit, select the box The eligible relative has a severe and prolonged impairment in mental or physical functions and requires assistance to perform a basic activity of daily living. at point 1 in the “Tax credit that can be claimed by a caregiver caring for an eligible relative (Section E in Schedule H” subsection of the “Schedule H/TP-1029.8.61.64 – Tax credit for caregivers” section in Form FAM (Jump Code: FAM).

TP-1000.TE – Online Filing of the Personal Income Tax Return by an Accredited Person (Jump Code: Q1000)

Part 3, Authorization to disclose confidential information has been removed from the form. Only Part 2, Statement and authorization to file the income tax return online, should be signed. This part gives the authorization to the preparer to electronically transmit the taxpayer’s return and obtain information regarding this return until such time that the notice of assessment by Revenu Québec is issued. Then, the preparer must file a Form MR-69 (Jump Code: Q69) to access confidential information or documents held by Revenu Québec with respect to the taxpayer or obtain a power of attorney to act on behalf of the taxpayer with Revenu Québec.

In the preparer profile, the option in the EFILE tab that was used to select the box to give authorization in Part 3 for all client files has also been removed.

TP-1029.9 – Tax Credit for Taxi Drivers or Taxi Owners (Jump Code: Q1029.9) –Addition of the calculation for the temporary increase in the tax credit for taxi drivers

In its March 27, 2018 Budget, the Québec Government announced a temporary increase in the refundable tax credit for holders of a taxi driver’s permit. This increase, which can reach $500, has been implemented for the 2017 and 2018 taxation years and is added to the actual credit to which is entitled a taxpayer claiming the tax credit for taxi drivers or taxi owners. This new measure had been integrated in version 4.0 of Personal Taxprep 2017, but has been removed in version 5, following a statement from Revenu Québec mentioning that no modification should be made in software programs concerning this temporary increase and that the required adjustments would be performed in the Revenu Québec systems to establish an accurate assessment for all taxpayers concerned by this measure.

As the lines required to calculate this increase have now been added to Part 2 of the Revenu Québec form, we integrated the calculations accordingly, and the temporary increase can now be claimed when the return is filed. With the increase, the maximum amount that can be claimed for this credit is $1,074 for 2018.

In addition, a section has been added to the summary TPF-1.X, Keying Summary for Forms in which data from Form TP 1029.9 display. If a tax credit for taxi drivers or taxi owners is claimed and the tax return is paper-filed, both Form TP-1029.9 and Form TPF-1.X must be enclosed with the tax return mailed to Revenu Québec.

TP-1029.AE – Tax Credit for the Upgrading of Residential Waste Water Treatment Systems (Jump Code: Q1029.AE)

Fields have been added in Part 4 of this form to indicate the amounts claimed in 2017 with respect to this credit.

TP-1029.RE – Tax Credit for the Restoration of a Secondary Residence (Jump Code: Q1029.RE)

The Post-disaster clean-up and preservation component has been removed from this form as it no longer applies. Only the Repair component remains in effect and can be claimed in 2018.

Fields were added in Part 6 of this form to indicate the amounts claimed in 2017 with respect to this credit.

Modification introduced by the Québec Government in the fall 2018 Update on Québec’s Economic and Financial Situation

ASSISTANCE QC – Refundable Tax Credit for Child Assistance (Jump Code: QASSISTANCE)

As part of the fall 2018 Update on Québec’s Economic and Financial Situation, the Québec Government announced an increase in the maximum amount of family benefits of $500 per year for the second and third children, with respect to the Child assistance payment component of the refundable tax credit for child assistance. Therefore, the maximum amount for purposes of calculating the child assistance payment will be increased from $1,235 to $1,735 for the second and third children of a family.

This increase will be applicable starting in January 2019 and retroactive payments will be made to families starting in April 2019.

This change has been integrated in version 1.0 of Personal Taxprep 2018.

The Child assistance payment will be renamed Family allowance in version 2.0 of Personal Taxprep 2018.

Preparer Profiles

AUTHORIZATION FORMS tab

The option Filing for clients who declared bankruptcy has been added to this tab for Form MR-69. By selecting this option, Form MR-69 will be applicable if you also selected the option File for clients for whom you do not have the authorization or whose authorization is expired and your client declared bankruptcy in the current year.

In addition, in the AUTHORIZATION FORMS tab for Form MR-69, you can now enter the contact person’s identification number. In the case of an individual in business who is a professional representative, this number can be used to obtain an individual’s authorization or power of attorney.

Ontario

Ontario

ON(S11) - Provincial Tuition and Education Amounts (Jump Code: ON S11)

The Ontario tax credits for tuition and education amounts have been eliminated since September 2017. However, the unused tuition amount related to prior taxation years and the unused education amount from prior years can be claimed (only by the student) for 2018 and future taxation years.

British Columbia

British Columbia

BC428 – British Columbia Tax (Jump Code: BC 428)

A new tax rate of 16.8% has been added for individuals whose taxable income exceeds $150,000.

The amount for infirm dependants age 18 or older (line 5820) and the caregiver amount (line 5840) have been replaced by the British Columbia caregiver amount (line 5817). This amount is calculated in Section “Line 5817 – British Columbia caregiver amount” of Form Worksheet BC428 (Jump Code: BC Credits).

The British Columbia caregiver amount can be claimed by an individual for his or her spouse or common-law partner or for an eligible relative of the individual who was dependent on him or her at a particular time in the year because of an impairment in physical or mental functions. An eligible relative of the individual is one of the following persons, aged 18 or over:

- a child or grandchild of the individual or his or her spouse or common-law partner;

- a parent, grandparent, brother, sister, aunt, uncle, niece or nephew who was resident in Canada at any time in the year.

The children’s fitness amount (line 5838), children’s fitness equipment amount (line 5842), children’s arts amount (line 5841) and education coaching amount (line 5843) have been eliminated.

The British Columbia farmers’ food donation tax credit has been extended until 2019.

BC479 – British Columbia Credits (Jump Code: BC 479)

Commencing in 2018, a sales tax credit amount can be claimed for the spouse or common-law partner only if the latter resides in British Columbia on December 31. This amount can be claimed on line 6035 of the BC 479 form.

T1231 – British Columbia Mining Flow-Through Share Tax Credit (Jump Code: 1231)

The British Columbia mining flow-through share has been extended until the end of 2018.

PROV BEN – Provincial or Territorial Benefit Worksheet (Jump Code: PROV BEN)

The BC family bonus is abolished beginning in July 2018. Therefore, this benefit is no longer calculated in Form PROV BEN in version 1.0 of Personal Taxprep 2018.

Alberta

Alberta

AB428 – Alberta Tax and Credits (Jump Code: AB 428)

Political contributions to the Senatorial Selection Campaign are no longer applicable. Therefore field 6004 has been removed.

Saskatchewan

Saskatchewan

SK(S11) - Provincial Tuition and Education Amounts (Jump Code: SK S11)

The Saskatchewan tax credits for tuition and education amounts have been eliminated since July 2017. However, the unused tuition amount related to prior taxation years and the unused education amount from prior years can be claimed (only by the student) for 2018 and future taxation years.

RC360 – Saskatchewan Graduate Retention Program (Jump Code: RC360)

A new section has been added in Personal Taxprep to help you track the lifetime limit of $20,000 for this credit.

Manitoba

Manitoba

MB428 – Manitoba Tax (Jump Code: MB 428)

The nutrient management tax credit has been eliminated.

MB479 – Manitoba Credits (Jump Code: MB 479)

The primary caregiver tax credit is no longer prorated based on the number of days. A full amount of $1,400 can be claimed if the taxpayer meets all the conditions. You must select a new check box displayed on screen above field 6125 to claim this credit.

Nova Scotia

Nova Scotia

NS428 – Nova Scotia Tax and Credits (Jump Code: NS 428)

The age amount, the basic personal amount, the spouse or common-law partner amount and the amount for an eligible dependant have increased for individuals with a taxable income of $25,000 or less. This increase is phased out for individuals whose taxable income is between $25,000 and $75,000. For more details on this calculation, please consult Form Worksheet NS428 (Jump Code: NS CREDITS).

Forms Removed

Federal

Federal

- Schedule 1 Line 364 – Public Transit Amount (Jump Code: 364)

Manitoba

Manitoba

- T1005 – Manitoba Tuition Fee Income Rebate (Jump Code: 1005)

The tuition fee income tax rebate and the advance tuition fee income tax rebate have been eliminated. - T4164 – Manitoba Odour-Control Tax Credit (Jump Code: 4164)

The odour-control tax credit has been eliminated, but unused carry forward amounts can still be claimed directly on Form MB428.

Electronic Filing

Due to its early release date, this version does not allow for electronic filing. The forms related to EFILE are under review in this version.

Information about EFILE

T1013 – Authorizing or Cancelling a Representative (Jump Code: 1013)

Due to its early release date, Personal Taxprep 2018 v.1.0 has not yet been approved for electronic filing of the 2018 version of Form T1013 or for printing the related 2D bar code. However, it will be available in Personal Taxprep 2018 v.2.0. If you want to electronically file Form T1013 before the release of Personal Taxprep 2018 v.2.0, you may use Personal Taxprep 2017. In that case, you should ensure that you update your EFILE password as soon as you renew your EFILE number for the year.

For more information on the electronic transmission of Form T1013, consult the Help.

Federal

Federal

Important dates

- February 18, 2019 – The EFILE On-Line transmission system will open.

- January 24, 2020 – The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at http://www.efile.cra.gc.ca/l-rnwl-eng.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at http://www.efile.cra.gc.ca/l-rgstr-eng.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form T1013, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to http://www.cra.gc.ca/representatives.

Québec

Québec

Important dates

- February 18, 2019 – The NetFile Québec system will open.

- February 18, 2019 – The Refund Info-line system will open.

- January 24, 2020 – The NetFile Québec system will shut down.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Technical Information

Technical Changes

We are proud to present the many technical changes to the enhanced version of Personal Taxprep. We are convinced that you will be pleased with these changes.

Enhancements to the user interface

The following enhancements have been made to the interface to refine the display of the many Personal Taxprep views:

- A single toolbar: The Standard and Advanced toolbars have been merged into a single toolbar that is always displayed which content adjusts according to the view selected. This new toolbar also provides new buttons with a more intuitive design.

- Access to the views: The shortcut bar that was available on the left side of the main screen of Personal Taxprep was replaced by the

button. When you click this button, a menu displays to allows you to select the desired view.

button. When you click this button, a menu displays to allows you to select the desired view. - Zoom: The tool allowing you to resize the form is now available in the right corner of the status bar.

To know how to use this tool, consult the page Customize Form Display.

The selected zoom factor will apply only to the forms. The Xpress tool and the diagnostics pane possess options allowing you to apply a zoom factor different from the one set for the display of forms. - AutoText: To facilitate the entry of data, which is sometimes repetitive, a list of AutoText suggestions in alphabetical order now displays from an alphanumeric field for which such list exists. Start entering an alphanumerical value and, if a list displays, click the value that you want to insert in the cell.

- TaxprepConnect status bar: The TaxprepConnect a status bar has been modified. The Download

button allows you to download a taxpayer's data, while the

button allows you to download a taxpayer's data, while the  icon allows you to display Form CONNECT, TaxprepConnect Download (Jump Code: CONNECT), to review the downloaded data. In addition, you can place the cursor of your mouse on the

icon allows you to display Form CONNECT, TaxprepConnect Download (Jump Code: CONNECT), to review the downloaded data. In addition, you can place the cursor of your mouse on the  icon to display the date of the last download performed for the active client file. For more information on TaxprepConnect, consult the page How to Download Tax Data with TaxprepConnect .

icon to display the date of the last download performed for the active client file. For more information on TaxprepConnect, consult the page How to Download Tax Data with TaxprepConnect .

Standardized presentation of information in the views

In addition to the Client Manager, Form Manager, EFILE Log view and EFILE Archives view, the following views are also presented in tables:

- Print Formats view

- Preparer Profiles view

- Filters and Diagnostics view

- Letters and Labels view

- Rate Tables view

- Advanced Network view (available with the Advance Network version)

Therefore, the functionalities available in these views to display, order and filter the information are identical. The following enhancements have been made to certain of the functionalities:

- the search is performed from the search box or by using the Ctrl+F shortcut. For more information on this topic, consult the page Search Through Views.

- the grouping area located at the top of the view is no longer displayed at all times. To group the content of a view according to a column, click the Group

button, and drag the column header to the grouping area displayed. To ungroup , click the Ungroup

button, and drag the column header to the grouping area displayed. To ungroup , click the Ungroup button.

button. - the

filters available on the column headers now provide more criteria to allow you to quickly find the information you are searching for. As a result, in the Values tab, you can enter the text you are searching for in the list to find the one that you want to use as a search criterion. A second tab is also available to allow you to use advanced filter functions. For more information, consult the page Filter Based on the Content of One Column.

filters available on the column headers now provide more criteria to allow you to quickly find the information you are searching for. As a result, in the Values tab, you can enter the text you are searching for in the list to find the one that you want to use as a search criterion. A second tab is also available to allow you to use advanced filter functions. For more information, consult the page Filter Based on the Content of One Column.

As mentioned above, the Print Formats, Letters and Labels and Filters and Diagnostics views are now presented in tables. In addition to taking advantage of the functionalities listed above, this new way of presenting information provides you with a way to order templates per template types, i.e. predefined or customized. As a result, the customized templates are displayed first in the view as they are the most frequently used templates.

Letter Editor: more editing tools available

The following have been enhanced in the Letter Editor used to define the content of letter templates. It also allows you to format and layout the letter.

- Tables: You can now add one or more tables in a letter template to display data on lines and in columns. For more information on tables, consult the page Add or delete a table.

- Review comments: You can now add comments to a letter template to enter any information, suggestion or question to be communicated to your colleagues responsible for updating or reviewing the letter template. For more information on review comments, consult the page Add, edit or delete comments.

- Formatting tools: For more information on the many tools provided in the Letter Editor consult the page About the Letter Editor.

Xpress and Diagnostics pane: easier-to-use tools

You can now float the Xpress tool panel or the diagnostics pane to move it. It can be moved to another screen to facilitate data entry in the main screen. To do so, in the toolbar, click the Xpress  button or the Diagnostics

button or the Diagnostics button, then click Float and move the panel to the other screen. Consult the video for a demonstration of the floating pane.

button, then click Float and move the panel to the other screen. Consult the video for a demonstration of the floating pane.

Options to resize the text, the zoom in  and the zoom out

and the zoom out  have been added to the Xpress tool and the diagnostics pane. For more information on these options, consult the pages Customize the Xpress List Display and Customize Diagnostics Display.

have been added to the Xpress tool and the diagnostics pane. For more information on these options, consult the pages Customize the Xpress List Display and Customize Diagnostics Display.

In addition, as it is now possible to float the Xpress tool panel, the Browse toolbar has been removed from the Display/Toolbar menu.

Changes relating to diagnostics

As the information in the diagnostics pane is presented in a table, a grouping area located in the top portion of the pane, where you can group the content of the pane according to a column, is also available. To group content in the diagnostics pane according to a column (for example, the Type), click the Group  button, then drag the column header to the displayed grouping area.

button, then drag the column header to the displayed grouping area.

Diagnostics are ordered by group and each group is presented in a separate table. The name of the group as well as the number of diagnostics are indicated on tabs:

- The Take Action tab displays the diagnostics issued by Personal Taxprep on which no action has yet been taken.

- The Reviewed tab displays the diagnostics that were reviewed during a first

or second

or second  revision.

revision. - The Ignored tab displays the diagnostics that were ignored during a first

or second

or second  revision.

revision.

Precisions relating to diagnostics

- An annotated diagnostic with the

or

or  indicators which is resolved remains in the Reviewed tab; however, the colour of the indicators displayed in the Annotation column is modified (

indicators which is resolved remains in the Reviewed tab; however, the colour of the indicators displayed in the Annotation column is modified ( or

or  ).

). - The diagnostic indicator for a tax cell

is no longer displayed when the diagnostics issued for that cell are annotated and no other diagnostic applies to this cell. Therefore, the diagnostic(s) display before the return is printed.

is no longer displayed when the diagnostics issued for that cell are annotated and no other diagnostic applies to this cell. Therefore, the diagnostic(s) display before the return is printed.

Help tools: easier to access

online help centre

Personal Taxprep provides you with an online Help Centre containing tax and technical information pages that will answer your various questions and will help you efficiently use Personal Taxprep. When you consult the Help, the relevant help topic will display in your computer's default Web browser.

At any time you can use the search box located in the top right corner of the page to obtain information on a specific topic.

In addition to providing regularly updated tax and technical information, the Help Centre contains support information (such as troubleshooting memos and frequently asked questions) and provides useful links to the CRA and Revenu Québec Web sites and certain help centres of software programs integrated with Personal Taxprep.

Professional centre

The Professional Centre now displays in your computer's default Web browser. This allows you to consult the Professional Centre in another screen while continuing to work in Personal Taxprep. Make sure that you enter your CCH services username and password in the options and settings of Personal Taxprep to take advantage of the services available in the Professional Centre.

Folder location

The location of certain folders related to Personal Taxprep that were in the CCH folder is now in the Wolters Kluwer folder. As a result, during installation, Personal Taxprep will prompt you for a different location for the following:

- the Personal Taxprep installation folder,

- the database and the transmission files,

- the templates, and

- the data exported of Taxprep slips.

|

Notes:

|

Enhancements to the Advanced Network view (available in the Advanced Network version)

Like the Client Manager, the Form Manager and the various templates views, the Advanced Network view is now presented in a table. You can take advantage of the different functionalities available in those views to customize the display according to your requirements and perform searches.

The Advanced Network view is split into two portions that allow you to view, add, delete and define properties for the users and groups:

- The upper portion relates to user groups.

- The lower portion relates to users: by selecting a group in the upper portion of the view, the users associated with this group are displayed in this location.

Portion relating to user groups

You can use the different commands available in the toolbar to add, copy or define properties for the groups. You can also access the different server features using the following buttons in the toolbar:

|

Click ... |

To ... |

|

|

Retrieve the previous version configuration. For more information, consult the page Retrieve the Network Configuration |

|

|

Define server properties |

|

|

Update the server |

The On-line and Off-line columns allow you to copy the profile rights of a group to the other group profile or another group profile using the Copy Profile command. The Off-line column indicates also whether or not the group has the rights required to work in off-line mode:

- the

icon indicates that the group has the rights required to work in off-line mode.

icon indicates that the group has the rights required to work in off-line mode. - the

icon indicates that the group does not have the rights required to work in off-line mode.

icon indicates that the group does not have the rights required to work in off-line mode.

To modify the rights to associate with a group, double-click the group for which you want to perform modifications. This way, you will have access to the Policies Editor to define the rights for the group profiles in off-line or on-line mode.

Note: The List of Users group allows you to view the list of all users in the lower portion of the view.

Portion relating to users

The bottom section allows you to view the users who are in the selected group. You can use the different commands available in the toolbar to:

- add a user;

- delete a user; or

- set user properties.

Advanced settings

Development toolkit

The guide Taxprep Development Toolkit Instructions and Excel file Taxprep T1 Development Toolkit Demo are only available in the online Help Centre.

In addition, the following functions have been renamed:

- ITaxprepReturn becomes IT120YYTaxprepReturn

- ITaxprepCell becomes IT120YYTaxprepCell

- Object becomes Taxprep20YYT1Return

To review the guide or to download the Excel file, consult the Taxprep Development Toolkit.

Silent Installation

You can now install Personal Taxprep silently using the Windows command prompt. For more information on the silent installation, consult the page Silent Installation.

Software integrations

Integration with CCH Scan

The enhancements below have been made to the CCH Scan pane:

- the list of bookmarks in the PDF file has been replaced by the Thumbnails and Bookmarks tabs.

- the Thumbnails tab allows you to display each page of the PDF file in miniature size;

- the Bookmarks allows you to display the list of bookmarks previously created in a PDF file.

- to add or search for a PDF file when no PDF file is attached to the return, you must now click the list Add or Select a PDF, then Modify or Search.

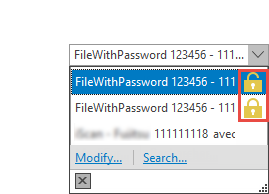

- In the list of files attached to the CCH Scan pane, and icon prompts you when an attached PDF is password-protected:

- the

icon indicates that the file is password-protected and locked. When you select a locked PDF file from the drop-down list of the CCH Scan pane, you must enter the password for that file to unlock it. You must enter the password each time you open Personal Taxprep

icon indicates that the file is password-protected and locked. When you select a locked PDF file from the drop-down list of the CCH Scan pane, you must enter the password for that file to unlock it. You must enter the password each time you open Personal Taxprep - the

icon indicates that the PDF file is password-protected and unlocked. You do not need to enter the password to open the PDF file.

icon indicates that the PDF file is password-protected and unlocked. You do not need to enter the password to open the PDF file.

- the

other integrations

- Integration with the CCH Accountants' Suite: Integrations with the CCH Document On-Premise and CCH Scan programs are available with Personal Taxprep.

- Integration with Taxprep Forms: The command Create a Taxprep Forms file, which allows you to create a Taxprep Forms client file including data from the Identification form, is currently not available in Personal Taxprep. The integration will be available as soon as the enhanced version of Taxprep Forms is released.

Modifications in the options and settings

The Apply button has been removed from the Options and settings dialog box. You must now make your modifications in the different panels and click the OK button.

The option to select the paper orientation when printing labels has been removed from the Labels/Format panel.

Roll Forward

Rolling forward 2017 client files

Your 2017 client files must be rolled forward using the Roll Forward command on the File menu, or from the Client Manager, if you want to do a batch roll forward, before you can access them with this version.

Planner Files

You can import client files created in Planner Mode in version 2017.

Slips

The roll forward is performed only for copies of slips in which amounts were entered last year as well as for copies including balances to carry forward, or attached notes or schedules to roll forward.

Attached notes

The attached notes are rolled forward, except if this option is cleared in the roll forward data options.

Rolling Forward ProFile, DT Max and TaxCycle client files (competitor products)

Make sure that the workstation’s regional settings are set to “English (Canada or United-States)” before rolling forward.

Notes – Attached Notes Summary (Jump Code: ATTN)

Schedule – Attached Schedule with Total (Jump Code: ATTS)

When rolling forward client files, the attached notes or schedules attached to fields in the comparative summaries are retained.

Calculations and Forms Not Available or Under Review

T1206 – Tax on Split Income (Jump Code: 1206)

Before 2018, the regulations relating to split income only applied to individuals under the age of 18. Commencing in 2018, these regulations have been extended to individuals aged 18 or over and the income subject to the split have been modified. The different forms and calculations covered by the new measures will be modified in Personal Taxprep 2018 v.2.0.

Calculations under review

- Early-filed returns (death or pre-bankruptcy) for 2019

- Planner Mode

Forms Not Available or Under Review

The following forms are presently not available or under review for one of the following reasons: either the CRA has not yet released the final version, or we have received the form too late to integrate it.

- Two-dimensional (2D) Bar Code

When printing a federal return (T1) with Personal Taxprep 2018 v.1.0, you will notice that the bar code(s) do not appear. This will not prevent the CRA from processing returns prepared with this version of the program. The option for printing bar codes on federal returns will be available in the next Personal Taxprep version. - TPF-1.U - Income Tax Return Data

Form TPF-1.U-V with “two-dimensional bar codes” is neither generated nor printed as part of the Québec income tax return (TP1) when using Personal Taxprep 2018 v.1.0 due to the fact that the form had not yet been approved by RQ prior to the release of Personal Taxprep 2018 v.1.0. Note, however, that this will not prevent RQ from processing the return. This feature will be available in the next version.

You can access the forms under review from the Form Manager. Although these forms are functional, they have not yet been updated for 2018.

The following form groups are under review:

- Forms relating to electronic filing (including Form T183)

- Forms relating to mining exploration, resources and RS&ED tax credits

- Forms relating to investment tax credits, stock savings plans and venture capital funds

- Forms relating to bankruptcy returns or the returns of taxpayers that are non-residents or that possess foreign property

- Forms relating to foreign tax credits

- Forms relating to the capital gains deduction

- Forms relating to provincial and territorial taxes for multiple jurisdictions situations

- Forms relating to instalments

- Forms relating to business, farming and fishing income and employment expenses

Other specific forms are also under review. They are labelled “Under Review” on screen and “Do not submit” watermark when printing.

Where to Find Help

If you have any questions regarding the installation or use of the program, there are several options for getting help. Access the Professional Centre for tips and useful information on how to use the program. If you are in the program and need help, press F1 to get help on a specific topic.

Videos available in the Professional Centre and on our Web site!

To learn more about Taxprep or to become familiar with the different features, consult the videos available in the Professional Centre or at www.taxprep.com.

To view a tutorial, access the "Tutorials" section in the Professional Centre, or visit the Taxprep Web site and, in the Support menu, select your product, then click the 2018 tax year. Videos are displayed under the Tutorials link. Simple as that!

Taxprep e-Bulletin

For your convenience, you are automatically subscribed to the enhanced edition of the Taxprep e-Bulletin, a free e-mail service that ensures you receive up-to-date information about the latest version of Personal Taxprep. If you want to review your subscription to Taxprep e-Bulletin, visit www.taxprep.com. In the Support menu, select Taxprep e-Bulletin. Click on My e-Bulletin in the “Taxprep e-Bulletin” section. You can also send an e-mail to cservice@wolterskluwer.com to indicate the products for which you wish to receive general information or information on our CCH software (Personal Taxprep, Corporate Taxprep, Taxprep for Trusts, Taxprep Forms or CCH Accountants’ Suite).